By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

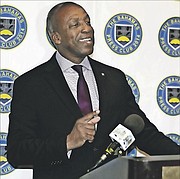

The Bahamas must explore “a legal challenge” to the European Union’s (EU) latest attack before the International Court of Justice, an ex-attorney general urged last night.

Alfred Sears QC, who held the post during the first Christie administration, warned the government against “rushing off to Brussels in a panic” to appease and/or make “secret agreements” in a bid to secure The Bahamas’ removal from the list of 23 nations deemed to pose a “high risk” of financial crime.

Instead Mr Sears, who also chaired the Caribbean Financial Action Task Force (CFATF) when he held ministerial office, called for a more strategic response - divided into short and medium-term steps - that drew on international diplomatic and judicial forums such as the United Nations (UN).

He urged The Bahamas to obtain regional support from CARICOM for the staging of a global forum on money laundering, terror financing and “unfair tax competition” issues in a bid to wrest control of these issues from the likes of the EU/OECD and bring them under the stewardship of the United Nations (UN).

Arguing that The Bahamas and other international financial centres (IFCs) were likelier to obtain a “level playing field” under the UN’s oversight, Mr Sears said this nation also needed to base its response to “blacklisting” type initiatives on evidence-based policies.

Suggesting that The Bahamas enhance the University of The Bahamas (UoB) research capacity, the ex-attorney general also argued that the Government “should use this crisis as an opportunity to dismantle the ring-fencing of foreign direct investment” and ensure similar incentives were made available to Bahamian investors.

“The Bahamian government seems to have been caught by surprise by the punitive action taken by the European Commission against The Bahamas,” Mr Sears said, noting that the EU had cited seven deficiencies in this nation’s anti-financial crime defences, all of which appear to have been based on the Financial Action Task Force’s (FATF) findings.

“I caution the Prime Minister, the attorney general, the minister of finance and the minister of financial services, trade and industry against rushing off to Brussels, in a panic, to make any ill-considered appeasements and secret agreements,” he added.

“The Cabinet of The Bahamas should assess the nature of this problem, weigh policy options, geo-strategic factors, and lay out to the Bahamian people a rational policy response informed by empirical data and the best technical advice, detailing how the Government will secure the short, medium and long-term national interests of The Bahamas with respect to the moving goal posts by the European Union.

“Short-term, panic-driven acts of appeasement by the Government will not produce a permanent resolution of this matter. The very foundation of the financial services sector, its organising assumptions since its construction under Stafford Sands in the 1950s, is being challenged.”

Mr Sears said The Bahamas’ short-term response, besides working to address the deficiencies identified by the FATF and escape its “monitoring list” in the shortest possible time, should involve hiring both local and international experts to advise on the situation.

He recommended Calvin Wilson, former CFATF director, who had aided The Bahamas’ removal from the FATF’s 2000 “blacklist”, while also calling for the formation of an advisory policy group of key ministers, regulators and financial services industry representatives to develop a future course for the industry.

Then, to avoid “future external threats and punitive measures” being imposed on The Bahamas, and give its financial services industry time to revamp its business model and improve its competitiveness, Mr Sears said it needed to lead a global push for all tax and financial crime-related issues to be dealt with under an international treaty overseen by the UN.

“The Bahamas should, with the support of CARICOM, initiate and lead an international lobby for the convening of a global forum calling for the formation of a United Nations treaty to cover issues of money laundering, terrorist financing and unfair tax competition,” he argued.

“From my recollection, certain members of the OECD, such as Canada and South Africa, were very helpful to The Bahamas during this period [2003-2007] and were sympathetic to the concept of a United Nations’ Treaty on anti-money laundering.”

Moving from the diplomatic to the judicial, Mr Sears then called on The Bahamas to “examine the feasibility of mounting a legal challenge, in concert with CARICOM, in the International Court of Justice at the Hague against the measures mounted by the European Union against the Bahamas, a non-member of the EU and a competitor in financial services to European and American onshore financial centres”.

“Under customary international law, it is illegal for a state or group of states to engage in acts of retorsion, retaliations, reprisals, intervention, or coercion to control smaller states, who are member of the United Nations, to force a change their internal or foreign policy,” he added.

“Save and except for secret agreements between The Bahamas and the European Union, the European Commission would lack any legal/juridical basis to take punitive measures against The Bahamas. Sir Lynden Pindling warned us that if we are not prepared to fight for our sovereignty, then we do not deserve to have it.”

Besides consolidating the financial services regulators into one giant supervisory body to improve “uneven” performance, and increase Bahamian representation on global bodies, Mr Sears also urged greater focus on local investment.

“The Government should use this crisis as an opportunity to dismantle the ring-fencing of foreign direct investment in The Bahamas, based on the Stafford Sands Model’s assumption that foreign direct investment is the sole basis for national development,” Mr Sears said.

“Based on that assumption, incentives, Crown Land, exemptions from taxes and subsidies are given almost exclusively to foreign investors, while Bahamian investors and entrepreneurs have restricted access to comparative venture capital, and denied equal consideration for incentives, tax exemptions, Crown Land and state subsidies. There should a level playing field both domestically and internationally.”

Comments

John 7 years ago

Time for Caribbean nations African nations and Central and South America to form their own alliance. Then approach organizations like the EU and the WTO as one block, or ignore them completely. Power of numbers.

Sign in to comment

OpenID