By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

Bahamian business owners yesterday admitted to feeling "some anxiety" over today's Budget as the Davis administration was urged to prioritise ease of doing business reforms to generate faster economic growth.

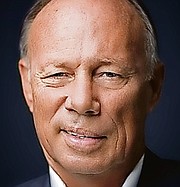

Mike Lightbourn, Coldwell Banker Lightbourn Realty's president, told Tribune Business that the sellers in one real estate transaction he has been involved with have been waiting for over a year to receive the sales proceeds but the deal has been unable to close because the Government has yet to confirm it agrees with the VAT due on the purchase.

"There's so many things they can do to help," he argued. "There's a sale that was completed over a year ago, but the attorney is holding the money because they are still trying to find out how much tax is owed. They've [the Department of Inland Revenue] lost the file. We gave them another file and they lost it again.

'It's just endless, all the hoops you have to go through. We don't know if they agree, disagree [with the valuation and VAT due]. No response. It's been over a year, and the vendors need the money for a legitimate purpose but the lawyer cannot release the money until the sale is completed. You can multiply that by hundreds.

"That would be the greatest thing they could do in this Budget; making it easier to do business. Make that the number one priority, and the economy will generate a lot more revenue because there is a lot more activity taking place."

Ben Albury, the Bahamas Motor Dealers Association (BMDA) president, told this newspaper that many in the private sector would have been worrying about what to expect in today's Budget because of the annual uncertainty over the actual tax, legislative and other measures it may contain.

"I wish I knew what to expect," he said. "This is always a time of some anxiety because you really don't know what to expect. I hope there will be some relief somewhere on the horizon, and I guess we'll have to be patient and see what happens. People always associate this with a change in taxation, so I hoe we don't see anything to worry, especially in our sector.

"We're still trying to rebound now, and get things on an even keel. We're still facing some challenges with the supply of parts and vehicles. All I can do right now is hope for the best. We haven't had any consultation or any questions asked as it relates to our industry.

"I'm trying to remain optimistic, and tomorrow [today] we'll let the chips fall where they may. I know there's a lot of people feeling the same way, a lot of business people feeling a little anxious right now and concern out there. It's definitely a little nerve-wracking."

Both Mr Albury and Mr Lightbourn backed the Government's drive to collect outstanding real property tax arrears, the former saying: "I know that the Government has been pushing aggressively in trying to collect taxes, which is good, especially that larger hanging fruit and things where people may have been getting away for a while."

Real estate is a sector that typically sees tax rates, structures and related legislation altered with every Budget. However, Mr Lightbourn voiced confidence that this year might prove to be an exception. "I personally don't think there's going to be any amendments to any of the tax rates," he said. "They're just going to keep going after people to pay their taxes.

"I personally don't have a problem once they're going after people with proper valuations. Some of the assessments are so out of line. They're going to reduce the rates on some things, increase them on others."

The Government, in a statement on today's Budget, pledged: "We'd like to emphasise that our approach is comprehensive and aimed at advancing and safeguarding the nation's progress and fiscal stability. This Budget serves as a testament to our commitment towards the common good and reflects the highest ideals of governance, transparency and accountability.

"Our priorities are focused on areas vital to national development. The Budget is poised to address salient issues while fostering economic growth and resilience. It is designed to make strides in national security, to bolster economic stability, and to enhance social welfare."

Turning to the economy, the Government said: "We aim to create an environment where businesses can thrive and employment opportunities are within reach of every Bahamian. Our initiatives are designed to drive sustainable economic growth, encourage foreign investments and promote Bahamian ownership and entrepreneurship in our economy. This Budget underscores our ongoing commitment to fiscal stability and economic dignity for all Bahamians.

"The third area of focus is social security. We are dedicated to ensuring every Bahamian has access to quality health services, education and essential social services. By investing in our people – our greatest resource – we aim to foster a society where everyone can achieve their full potential. The Government is devoted to improving social welfare, enhancing our education system, promoting arts and culture, and cultivating our young generation's skills and talents."

Promising "prudent" management of the country's fiscal resources, the Government added: "The Government remains committed to reducing the impact of inflation, increasing our resilience to climate change, and improving food security.

"This is a pivotal moment for our nation. We understand the challenges we face, but we also see the opportunities ahead. Our focus is on the future, a future where we not only recover from the trials we've faced but also forge ahead towards greater security and progress. As we move forward, we are confident that we can build a more prosperous and resilient Bahamas together."

Comments

Use the comment form below to begin a discussion about this content.

Commenting has been disabled for this item.