By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

A Bahamian QC has slammed the “flawed” bid by Sarkis Izmirlian to defeat the “shareholder oppression” counter-claim brought against him by Baha Mar’s main contractor.

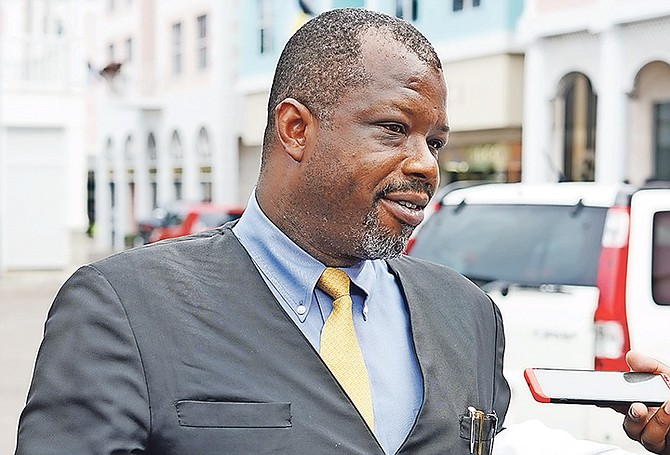

Wayne Munroe QC, acting on China Construction America’s (CCA) behalf, argued that there was nothing in Bahamian law to prevent the Chinese state-owned contractor from bringing such an action in New York or elsewhere using section 280 of this nation’s Companies Act.

In a direct rebuttal to assertions by Oscar Johnson, Higgs & Johnson’s managing partner and litigation chief, Mr Munroe alleged that there was nothing in the Companies Act to make the Supreme Court the exclusive tribunal for hearing all cases brought under it.

Mr Munroe, in legal documents filed with the New York State Supreme Court, which have been obtained by Tribune Business, also refuted Mr Johnson’s argument that so-called “shareholder oppression” needed to be present or ongoing for CCA’s claim to have merit.

Mr Izmirlian and his attorneys had asserted that Baha Mar Ltd’s dissolution on January 28, 2019, meant the company had “ceased to exist” before CCA brought its May 14 claim thereby rendering it invalid.

However, Mr Munroe said previous rulings had set a precedent for righting “an enduring unfair state of affairs” even though the company in question may no longer exist. And Bahamian “procedure”, he argued, meant that CCA’s counter-claims were made in late 2017 when Baha Mar’s original developer first filed his $2.25bn fraud and breach of contract claim.

Mr Munroe’s riposte to Mr Johnson’s rival evidence comes as the preliminary legal dual between Mr Izmirlian and CCA heats up over the former’s bid to persuade the New York court to dismiss the Chinese contractor’s “shareholder oppression” claim.

CCA is alleging that Mr Izmirlian exploited his position as Baha Mar’s majority shareholder to take actions that ultimately wiped out its $150m preference share investment in the original project (even though it was subsequently selected for the $700m contract to complete the development).

Baha Mar’s original developer has blasted CCA’s counter-claim as “impermissible”, and cited numerous reasons why it should be “stricken”, including the fact that it can only be “validly” heard by the Supreme Court since it is based on Bahamian law. Mr Munroe and his client, though, feel differently.

“In my considered opinion.... there is no prohibition provided by Bahamian law to this New York court considering a claim brought under section 280 of the Companies Act and providing a remedy thereunder if is minded,” Mr Munroe alleged.

“I can find nothing in the words of the section or the rest of the Companies Act that would lead me to conclude that a complainant may only apply to the Supreme Court pursuant to section 280 of the Companies Act.”

Mr Munroe, who admitted that he represented the Gaming Board during the Supreme Court hearings that ultimately resulted in Baha Mar’s winding-up and sale, said there were numerous avenues to make “oppression” claims besides the Companies Act.

Identifying arbitration as one, he concluded: “I see no indication... that the ability to give relief pursuant to section 280 of the Companies Act is limited to the Supreme Court.” And, rejecting arguments that the Act’s variety of remedies were broader before the Supreme Court, Mr Munroe added: “With respect, this reasoning is flawed.

“Arbitral tribunals and foreign courts often make awards and orders that are to be enforced in The Bahamas. The question of whether a particular remedy available pursuant to section 280 of the Companies Act should be given or any particular order made is a matter for the selected dispute resolver taking into account the facts of the case and the procedural rules governing the selected process. After a remedy or relief is granted the matter of enforcement of the order of this court in The Bahamas would follow as in any other case, if necessary.”

Mr Munroe then rejected Mr Johnson’s argument that the Companies Act’s “shareholder oppression” remedy dealt only with ongoing or present conduct, rather than what happened in the past, thus creating a “fatal flaw” in CCA’s argument due to Baha Mar’s prior dissolution.

Asserting that the Companies Act’s section 280 “provides redress for an enduring unfair state of affairs”, even though the oppressive conduct that may have caused it has ceased, Mr Munroe said the argument surrounding Baha Mar’s dissolution was incorrect.

“In The Bahamas, procedurally, the claims in a counterclaim are deemed to have been commenced on the same date as the action in which it is pleaded,” he said.

Noting that the court files indicated Mr Izmirlian’s claim was brought in 2017, Mr Munroe added: “If that is indicative that this action was commenced in 2017 then the section 280 application made by the counter-claim would be deemed to have been made in 2017 - well before Baha Mar Ltd would have been dissolved.

“As a result, taken that the date of the claim by the counter-claims is 2017 prior to Baha Mar’s dissolution, the question would be whether [Mr Izmirlian] was liable as at that date - 2017. If the court finds that [he] was liable then this liability existing at the time before the dissolution of Baha Mar Ltd would continue notwithstanding Baha Mar’s later dissolution in 2019.”

Even if Mr Izmirlian’s latest legal initiative proves successful, CCA still has two other elements to its counter-claim that have yet to be challenged. Both parties appear equipped for a long, costly fight that will take years and plenty money to resolve.

Comments

Use the comment form below to begin a discussion about this content.

Sign in to comment

OpenID